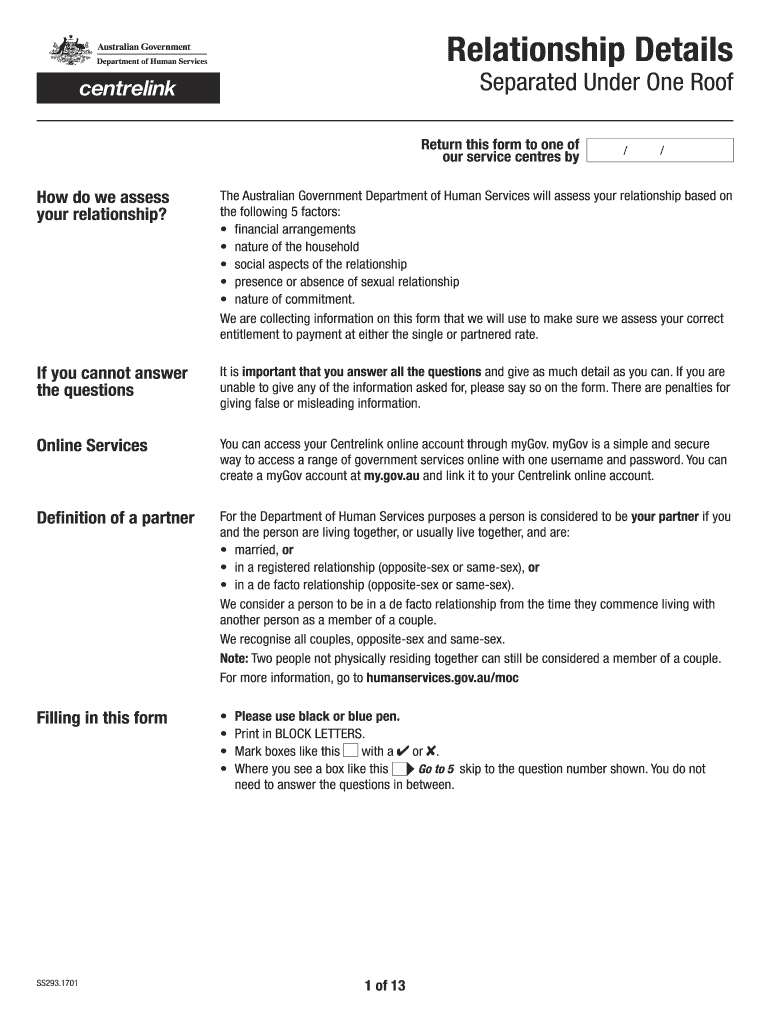

AU SS293 2017 free printable template

Get, Create, Make and Sign AU SS293

How to edit AU SS293 online

AU SS293 Form Versions

How to fill out AU SS293

How to fill out AU SS293

Who needs AU SS293?

Instructions and Help about AU SS293

Hi there and happy New Year to everyone I hope you had a fantastic New Year's Eve and that you're starting the New Year first ever the New Year in a positive frame of mind so if you're watching for the first time my name is Maryann Hanson I'm the owner and the counselor at new journeys counseling, so I provide counseling not only to couples but also to individuals and my specialist areas are relationships, but they also provide counseling for depression for stress and for low self-esteem, and I'm going to be launching my coaching page soon and Ill kind of give you more information about that and throughout this month so something I wanted to talk about is something which I think affects many couples and that is for people who are in relationships where they are broken up, so they're separated maybe some X and there could even be a divorce, but they're still living in the same house now I've been watching quite a few programs about this recently where club partners are living in the same house, and I'll give you some reasons' hi Luis hi thanks for tuning in I hope you had a good arm New Year's Eve, so there are lots of people who for whatever reasons they cannot move out of the house that they're living in however the relationship is dead so can you imagine for a second if you were it would be the same as say you quit your job you gave your notice in it your job, and then you still have to continue to well sometimes you still have to work there for them 30 days but what if after the 30 days they said well no you've got to stay here for a Nova because we can't afford to let you go until we find another and person to replace you have to stay imagine you're going to be in a situation where you're having to still go into that environment which you didn't want to be in, but you're gonna somehow after that you're going to have to handle it happy New Year to you as well Luis thanks for tuning in and so some reasons first I'm gonna talk about the reasons then I'm gonna talk about the issues that can come up if you are a couple that's living in the same home but leading separate lives because you're not together anymore, and then I'm not gonna talk about what you can do um banker Taken sees someone bandura thank you happy New Year to you so some of the reasons that people end up in this situation is because of a lack of finances, so you could be in a relationship with someone and then the relationship is going really well you could even be it could be a marriage it could just be a long term where you're living together and then for whatever reason the relationship breaks down, so the marriage breaks down you decide you're getting divorced, or you decide you're splitting up as a couple but neither of you can afford to move out of that property, so you make a decision that you're going to continue to live together now at the point you're making the decision it's not what's in the best interest for you emotionally because everyone would have known that...

People Also Ask about

How do you prove you are separated to Centrelink?

What is ss293 form?

Can separated couples live in same house?

What is a mod s form?

How do you separate while living together?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ss293 form?

Who is required to file ss293 form?

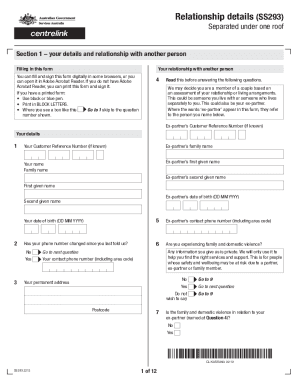

How to fill out ss293 form?

What information must be reported on ss293 form?

What is the purpose of ss293 form?

How can I get AU SS293?

How do I edit AU SS293 online?

Can I create an electronic signature for signing my AU SS293 in Gmail?

What is AU SS293?

Who is required to file AU SS293?

How to fill out AU SS293?

What is the purpose of AU SS293?

What information must be reported on AU SS293?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.